Life Insurance in and around Independence

State Farm can help insure you and your loved ones

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

- Simon Kenton High

- Independence, KY

- Kentucky

- Ohio

- Cincinnati, Ohio

- Edgewood, Kentucky

- Ballyshannon

- Hearthstone

- Morning View

- Covington

- Piner

- Independence Oaks

- 3L

- Taylor Mill

- 536

- Cherokee

- Fort Thomas

- Florence

- Kenton County

- Boone County

- Erlanger

- Elsmere

- Crestview Hills

- Lakeside Park

Be There For Your Loved Ones

When facing the loss of your partner or your spouse, grief can be overwhelming. Regular day-to-day life halts as you prepare for funeral services arrange for burial, and face life without the one you love.

State Farm can help insure you and your loved ones

Life won't wait. Neither should you.

Independence Chooses Life Insurance From State Farm

Having the right life insurance coverage can help loss be a bit less stressful for your loved ones and give time to recover. It can also help cover matters like ongoing expenses, college tuition and grocery bills.

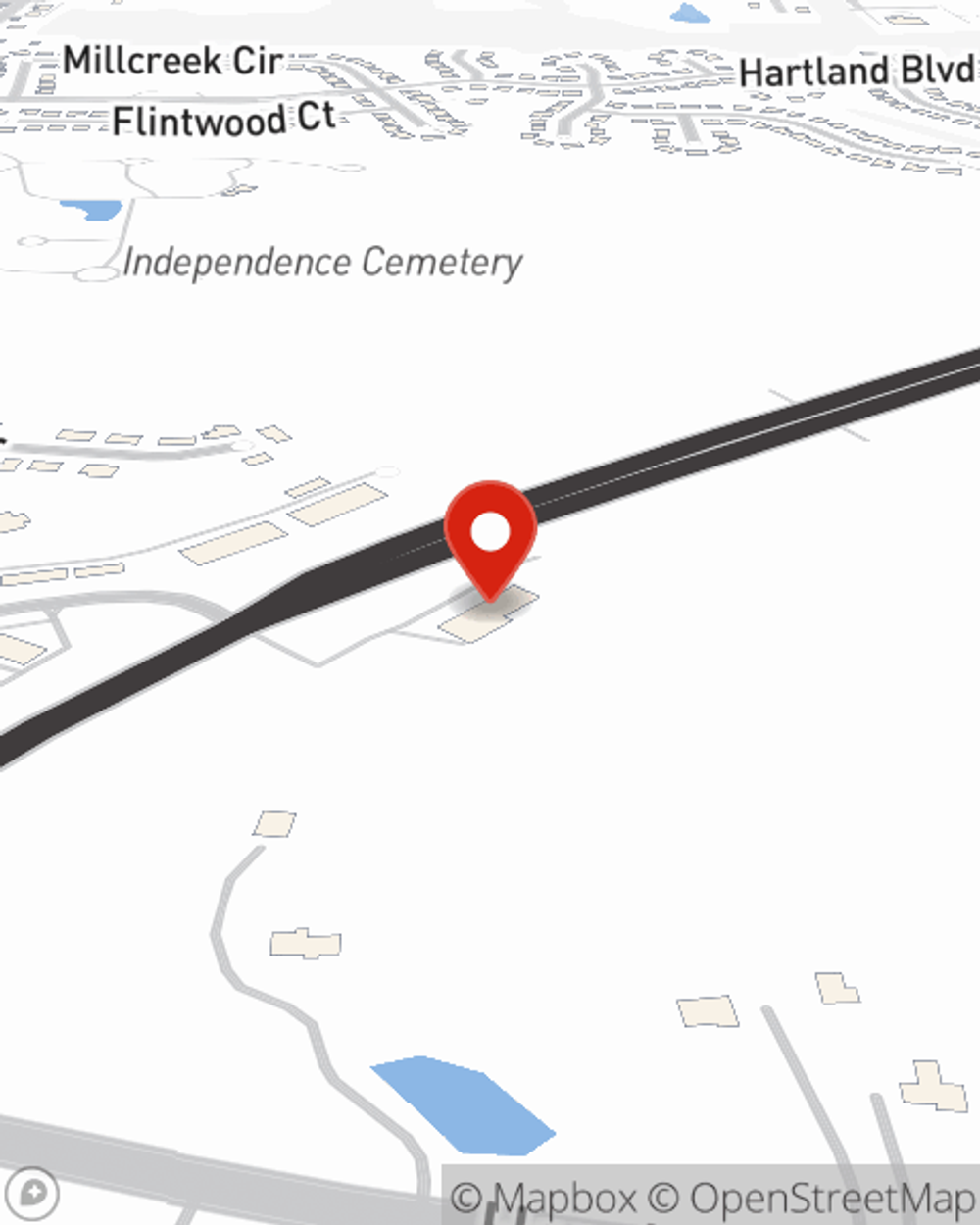

Don’t let concerns about your future stress you out. Visit State Farm Agent Joel Bergantino today and see how you can benefit from State Farm life insurance.

Have More Questions About Life Insurance?

Call Joel at (859) 356-5611 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.

Joel Bergantino

State Farm® Insurance AgentSimple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.